Mt. Gox Moves $9 Billion in Bitcoin. What Does It Mean for the Market?

Recent events involving Mt. Gox have received significant attention, not just because of the hefty sums involved, but also due to the potential impact on cryptocurrency markets.

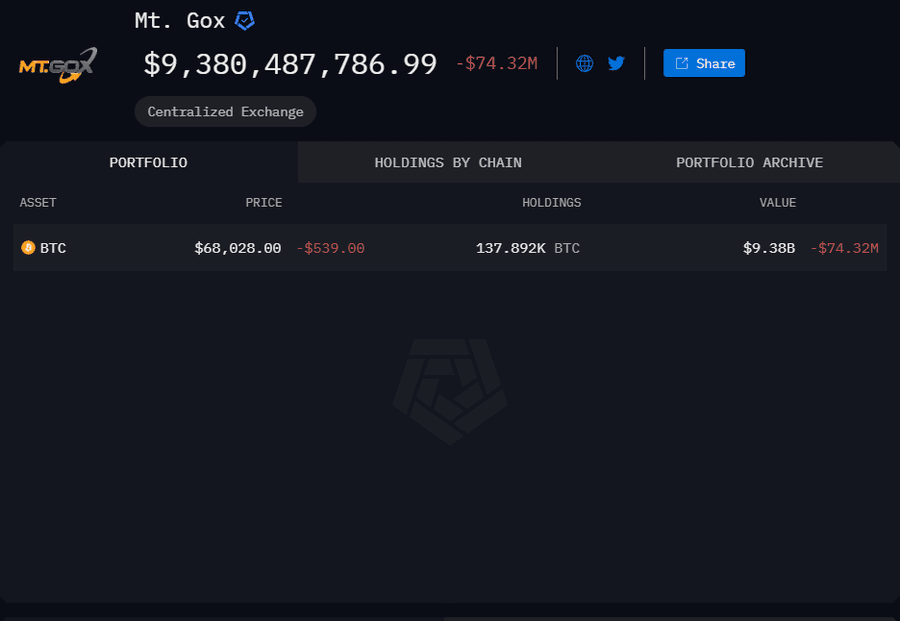

Over 140,000 BTC, worth around $9 billion, were transferred from Mt. Gox wallets to an unknown address in thirteen transactions, possibly as part of a plan to repay creditors by October 31, 2024. This marks the first movement of these funds in over five years, stirring up ripples in the crypto world.

Related: What Happens to Lost Bitcoin?

Troubled Past and Its Ripple Effects

Founded in 2010, Mt. Gox once processed 70% of all bitcoin transactions worldwide. However, a massive cyberattack in 2014 severely impacted its operations, resulting in the loss of about 850,000 BTC belonging to customers and the company. Since then, creditors have been eagerly awaiting the return of their assets, which is expected to put selling pressure on BTC markets.

But not everyone in the industry is pessimistic. Alex Thorn, head of research at Galaxy, expressed in a post on X that he believes most of the transferred bitcoins will end up with creditors rather than being sold on the open market.

BTC from Mt. Gox moved in the last hour, likely marking the start of distributions to creditors. Personally, I expect most BTC will remain locked up, though I can’t say the same for BCH.

Wallet activity indicates these movements occurred over thirteen transactions. A probable test transaction of $3 was made on May 20, followed by a smaller transaction of $160 early Tuesday morning. The remaining transactions varied between $1.2 billion and $2.2 billion in bitcoins.

This is the first movement of assets from Mt. Gox’s cold wallets in over five years, likely part of a plan to return assets to creditors. The transactions are happening ahead of the October 31, 2024, deadline by which Mt. Gox plans to repay its creditors. The settlement plan includes 142,000 BTC, 143,000 Bitcoin Cash (BCH), and 69 billion Japanese yen.

The repayment process follows the Tokyo District Court’s approval of a rehabilitation petition. In 2021, 99% of creditors voted in favor of the rehabilitation plan.

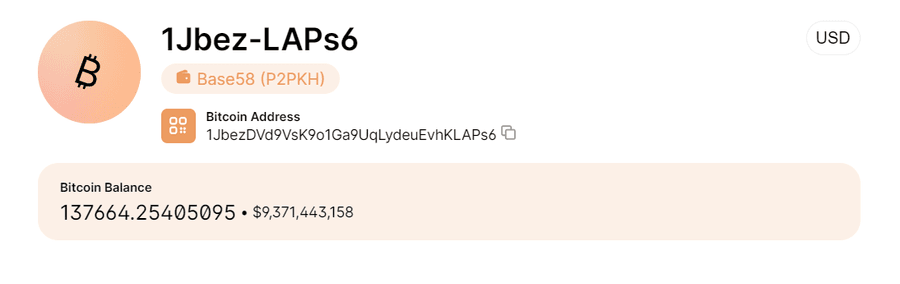

According to Bitinfocharts data, all of Mt. Gox’s bitcoin has now effectively been moved into a single bitcoin wallet.

Despite this significant transfer, the Mt. Gox wallet still holds BTC assets worth about $9.3 billion.

Market Reaction

The crypto community speculates that this significant transfer might trigger a market sell-off due to the long-awaited payouts to Mt. Gox creditors. There are concerns that a substantial portion of these transferred assets could be sold on the open market.

The market responded quickly to the news. Bitcoin’s price dropped nearly 4% from the previous day’s high of $70,600 and is now trading around $67,800.

Similarly, Bitcoin Cash saw a decline of about 7% from its peak of $503.70, and it is currently trading around $468.

More Info:

- Bitcoin Runes: New Era or Biggest Crypto Flop?

- Bitcoin Breaks $71K: Analyzing the Factors Behind the Rise

The transfer of $9 billion worth of Bitcoin from Mt. Gox has undoubtedly shaken up the crypto market, evoking a mix of anxiety and anticipation. As the October 31, 2024, deadline approaches, the true impact of these movements will become clearer. For now, just remain watchful.

Disclaimer: All materials on this site are for informational purposes only. None of the material should be interpreted as investment advice. Please note that despite the nature of much of the material created and hosted on this website, HODL FM is not a financial reference resource and the opinions of authors and other contributors are their own and should not be taken as financial advice. If you require advice of this sort, HODL FM strongly recommends contacting a qualified industry professional.